Personalized Mutual Fund Solutions for High Returns

Small Investments, Big Rewards

Dviija Fintech provides investment solutions that allow individuals to pool their resources and invest in a diversified portfolio of stocks, bonds, and other securities. Through strategic diversification, we reduce market volatility risks and promote long-term financial stability.

Our expert team designs personalized investment strategies aligned with each investor’s financial goals, risk tolerance, and time horizon. Whether the objective is building wealth, income generation, or capital preservation, we help clients build balanced, diversified portfolios tailored to their specific needs.

Why Choose Our Mutual Fund Solutions?

- Expert-Led Diversified Portfolio: Our team of seasoned professionals, monitors market volatility and adapts to new developments, ensuring that investors’ investments are well-protected.

- Tailor-Made Investment Plans: We create customized investment strategies that align with investors’ unique goals, risk appetite, and time horizon.

- Risk Mitigation: We spread the portfolio risk across multiple assets through diversification, helping to minimize losses during volatile market conditions.

- Regular Updates & Compliance: Stay informed with real-time updates on regulatory changes and market shifts.

- Investor Education: Join workshops led by industry experts to stay ahead of the curve and make informed decisions.

Key Benefits of Mutual Fund Services

- Achieve Financial Goals: We provide strategic investment options to help clients reach important milestones such as retirement, home ownership, or funding education.

- Portfolio Restructuring: Our experts optimize existing investments to maximize returns and ensure consistent growth.

- Optimal Asset Allocation: Tailored asset allocation strategies are provided, based on individual goals and risk tolerance.

- Tax-Efficient Planning: Clients benefit from expert tax planning services, designed to grow wealth while minimizing tax liabilities.

- Wealth Creation: We focus on data-driven investment decisions to build long-term wealth and ensure financial security.

How We Work

We are dedicated to growing clients’ investments and helping build their financial corpus.

Our approach includes:

- Comprehensive Portfolio Management: We continuously monitor portfolios and make timely adjustments to maximize returns and minimize risks.

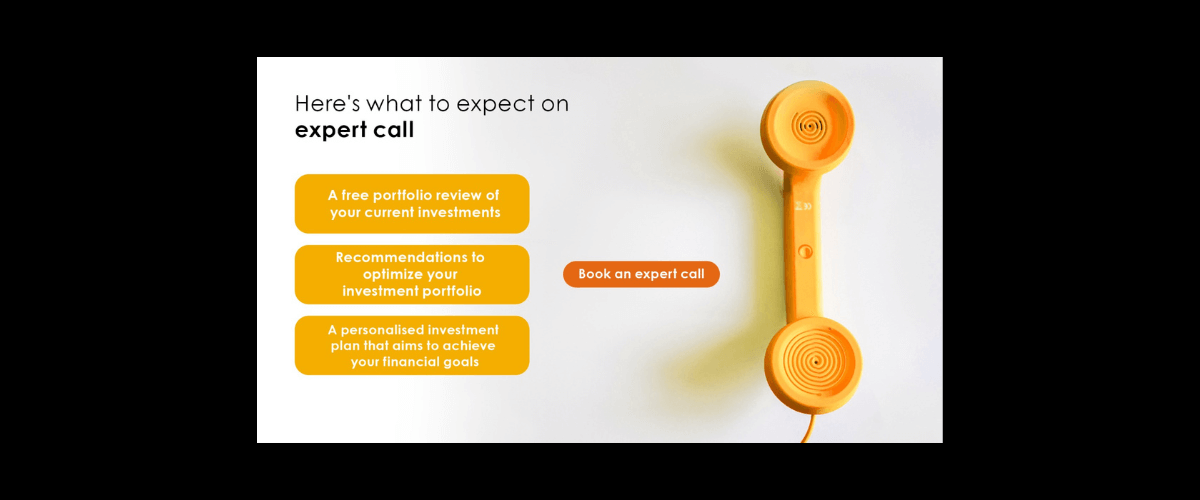

- Guided Investment Process: From selecting the most suitable funds to ongoing monitoring, strategic switching, and providing expert guidance at every stage.

- Tailored Recommendations: Clients receive personalized investment advice, ensuring their financial objectives are consistently met.